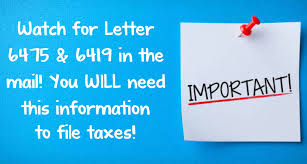

New Tax Documents Needed to File Your 2021 Return

Many of you are already gathering your 2021 tax documents in hopes of filing as quickly as possible in anticipation of a refund. But be patient. I know you've heard that before. But it's true again this year.

So before you file, let’s review the tax documents we need to properly file your 2021 tax return.

New Tax Documents for 2021

The IRS identifies two new documents as Letters 6419 and 6475. Both are issued in connection with some COVID-19 relief created by the American Rescue Plan Act (ARPA) that became law last March 2021.

Letter 6419

This letter is on the way to families who got

half of the enhanced Child Tax Credit (CTC) amount last year.

The credit for qualifying dependents for the 2021 tax years

was increased to $3,600 for younger children and $3,000 for older children,

also as part of the ARPA. In addition, that new law instructed the IRS to send

eligible families half of the credit amounts early as monthly payments from

July through December 2021.

To get the balance of the CTC, which could be as much as

$1,800 per each child age 5 of younger or $1,500 for dependent children ages 6

to 17, you must claim it when they file their 2021 taxes. Letter 6419 will help

you calculate the correct remaining credit you're due.

You'll need to file Schedule 8812,

Credits for Qualifying Children and Other Dependents, with your Form 1040 to

claim the credit.

Letter 6475

This letter will help you know whether you

received the maximum COVID relief amount that was authorized by the ARPA. If

you got the previous two EIPs, then this latest letter will not be new to you.

EIP payments of up to $1,400 person were delivered to

individuals who were eligible based on their prior 2020 or 2019 tax return

information. Taxpayers also got $1,400 for each qualifying child.

Shortly after ARPA became law last March, the third

EIPs started going out, and were distributed throughout 2021.

The IRS said that most eligible taxpayers got the money. But

most is not all.

If you didn't get the maximum 2021 EIP, Letter 6475 can help

you get additional coronavirus relief for which you qualify when you file your

2021 tax return. You'll use the information in the letter to claim the Recovery

Rebate Credit on your taxes.

Since the COVID relief payments technically were credits,

any amount you are due as the Recovery Rebate Credit on your 2021 tax return

can help reduce any tax you might owe. Even better, the credit is refundable.

This means that if you have more of the credit than you owe

Uncle Sam, or you don't owe any tax, then you'll get the credit amount as a

refund.

Familiar Tax Documents

Now here's a listing of the more popular tax information documents that you can find online, in your inbox or mail box in the next coming days or weeks. Most of these are due to be mailed by Jan. 31.

W-2 — This is the tax form

that everyone eagerly anticipates. It's the wage statement from

your that details how much money you made, how much income tax was withheld,

the amounts taken out for Social Security and Medicare, and contributions to

workplace benefit programs, such as 401(k) and similar retirement plans,

medical accounts and child care reimbursement plans.

W-2G — This form is specially designed to

report gambling winnings, hence the appended G. It's sent to winners who get:

- $1,200

or more from bingo or slot machines,

- $1,500

or more in winnings (reduced by the wager) from keno,

- More

than $5,000 in winnings (reduced by the wager or buy-in) from a poker

tournament,

- $600

or more in gambling winnings (except winnings previously noted) and the

payout is at least 300 times the amount of the wager, and

- Any

other gambling winnings subject to federal income tax withholding.

1095 form series — These forms were originally created

to report Affordable Care Act data. However, there have been some changes along

the way.

The Tax Cuts and Jobs Act (TCJA) eliminated the individual

mandate penalty at the start of the 2019 tax year. That penalty was the amount

that previously was added to your taxes if you didn't have what was deemed

adequate insurance coverage. However, the TCJA did not do away with the

associated Obamacare reporting requirements. By law, the forms still must be

issued.

That meant you might get at least one of the 1095 series

insurance coverage tax statements listed below even though you didn’t need it for

federal filing purposes to document your 2021 tax year medical coverage and

avoid the federal penalty.

Note, however, that while the federal enrollment mandate and

penalty is gone, some states still require their residents to get medical

coverage or pay a penalty.

Due to the TCJA changes, the IRS has extended some of the

deadlines for issuing these forms. State deadlines, however, could be

different.

So, just keep your eyes open for these forms. You'll need

the A version to reconcile or claim any ACA premium tax credit (PTC) you

got in advance or are eligible to file for on your return. The B and C versions

are informational, and you can simply store them with your other tax records

for the year.

- Form

1095-A, the Health Insurance Marketplace Statement, debuted for

the 2015 tax year. It is sent by the exchanges where individuals purchased

their medical coverage. As noted, use its data in connection with PTC

claims.

- Form

1095-B is issued by health care insurance issuers or some

smaller companies that provide coverage for employees. It confirms that

you had workplace-provided healthcare that met the ACA's acceptable

minimal health insurance coverage standard. It also shows how long you

were covered and which family members also were on your policy.

- Form

1095-C is the same as B, but is issued by large employers.

1098 — This form lists how much mortgage

interest a homeowner paid on the loan. In most cases, this amount is fully

deductible. The IRS has an official 1098 form, but most lenders tend to use a

substitute document that contains the same data.

This form also includes another key itemized tax deduction,

the amount of real estate taxes on the property that the mortgage lender paid

on your behalf the previous tax year. The cap of $10,000 is still in effect,

regardless of what's shown here.

1098-E — The interest paid on your student loan

is reported on this form and is sent by your lender if the interest paid is at

least $600. You may be able to deduct this interest and possibly other

loan-related amounts, such as origination fees and capitalized interest.

1098-T — Universities issue this tuition

statement to students. It shows the amount of qualified education expenses the student

paid. The information is needed to help in the claiming of education-related

tax benefits, such as the American Opportunity or Lifetime Learning tax

credits.

1099-INT —

You'll get one of these forms for each savings, CD or other investment account

in which you earned more than $10 in interest. Even if you reinvested the

interest instead of receiving it as a cash payment, it is still reported as

taxable income.

1099-DIV —

Earnings from stocks and mutual funds are reported here, including dividends

and capital gains distributed that are more than $10. If you used the dividends

or distributions to buy more shares, you still have to report the income and pay

taxes. However, the distributions and certain, qualified dividends are taxed at

the lower capital gains rates.

1099-B — If you sold stocks, bonds or mutual

funds, you will receive a 1099-B from your broker or mutual fund company. It

will detail the number of shares sold, when sold and the amount of the sale.

Since 2011, brokers also have been providing information on the basis (the cost

of an asset plus some adjustments) of sold stock. This information, along with

the date you bought the shares and the amount you paid for them, will help you

figure your taxes on your profit. 1099-B forms are due to investors by Feb. 15.

1099-G — When you get a refund of state or

local taxes, you'll get this form. If you claimed those taxes as an itemized

deduction on your previous year's federal tax return, you must report the

1099-G amount as income in the year received. And millions of people will

get 1099-G forms this filing season for the unemployment

benefits they received from job losses caused by the COVID-19.

1099-K — Payments you received via credit or

debit cards or from third-party payment processors, such as PayPal, Amazon

and eBay, will be reported on this form. There are triggers for amounts

($20,000) and number of transactions (200), so not every person who receives

such payments will get a 1099-K. This income, however, is taxable and should be

reported even without issuance of a 1099-K.

1099-MISC —

In 2020, this form changed from the document used to report payments for contract work

(now 1099-NEC), to being used to report rent or royalty payments or prizes and

awards, such as winnings from television or radio show contest. Form 1099-MISC will

also go to some other payment types, such as crop insurance proceeds. When a

1099-MISC is required, it will be issued when the payment amount is $10 or more

in royalties, or $600 or more in other types of miscellaneous income during a

calendar year.

1099-NEC — This form primarily reports contract work

performed by self-employed individuals (non-employee compensation). You should

get one if you earned $600 or more from a job. You also should get a separate

1099-NEC from each client that paid you that much. This form is the self-employed

equivalent of a W-2 only without any taxes paid via withholding. Even if you

don't get a Form 1099-NEC for a job because the amount paid to you was less

than $600, that $1 to $599 payment is still taxable income.

1099-R — If you received a pension or a

distribution from an individual retirement account or workplace retirement

plan, you'll get a Form 1099-R with those details. The form is issued by your

broker, pension plan manager or mutual fund company. Even if you rolled the

retirement money into another employer-provided 401(k) plan or an IRA, you'll

still get a 1099-R. The form has several boxes that differentiate any taxable

amount from the gross distribution amount. You'll also get a 1099-R if you

converted a traditional IRA to a Roth IRA. Again, a rollover usually is not a

taxable event, but a pension payout may be.

5498 — Any contributions you make during the

tax year to any individual retirement account are reported on this form. The

5498 shows traditional IRA contributions that might be deductible on your tax

return, as well as any rollovers made during the last tax year. It also reports

amounts that were recharacterized from one type of IRA to another. 5498 forms

with information on your contributions to such accounts are not due to you until

May 31. The IRS also says, however, that the issuer should make the

retirement account's fair market value (FMV) and, if applicable, required

minimum distribution (RMD) information, available by Jan. 31.

5498-ESA — This account reporting form has

details on contributions to Coverdell Education Savings Accounts, formerly

known as Education IRAs. The child named as beneficiary of the Coverdell should

get a copy of this document by April 30. This information is important if

you went overboard last year in contributing to this educational savings

vehicle. If your total contributions made to all your Coverdell ESAs for 2021

exceeded $2,000, you must withdraw the excess, plus earnings, by June 1, 2022,

or you may owe a penalty.

Schedule

K-1 — If you received money from an estate, trust, partnership or

S corporation last year, you should get a Schedule K-1. However, because of the

complexity of many of these financial arrangements, account managers tend to

send out K-1s later in the tax season, often not until well after the April tax

return filing deadline.

That's why filers who get K-1 forms usually file Form 4868,

Application for Automatic Extension of Time to File. This gets you six

more months to get your K-1 and any other tax statements you need to fill

out your Form 1040.

Whew, that was a LOT!

If you have any questions about the information discussed here just drop us a line.

For the latest tax updates be sure to follow us on Twitter, Facebook and LinkedIn. You can also visit our website at https://arndtcpas.com or give us a call at (417) 882-9000.