Tax Differences: Employee vs Self-Employed (on Sch C)

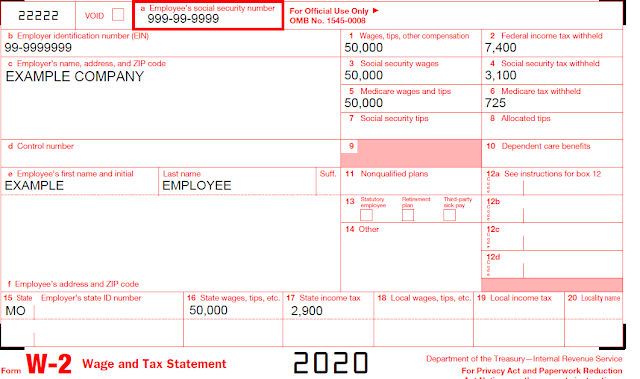

Have you recently transitioned from being an employee of company to being self-employed (or vice versa)? Or are you considering such a transition? In this post, we will explore the main tax differences of being an employee versus being self-employed (with earnings reported on Schedule C) that you NEED to know. Or check out our video on the same topic here . EMPLOYEE & TAXES As an employee of a company, you should receive a Form W-2. You may or may not realize exactly what this form, or your paychecks each pay period, say about taxes. So let’s dive into that. 😊 First, we need to discuss that there are two main types of taxes reported on Form W-2/paystubs. FICA (Social Security & Medicare) taxes – 7.65% deducted from each paycheck (usually you will NOT get this back at all) Note: The Social Security 6.2% is only accessed on the first $137,700 (for 2020) of wages Did you know… Your employer also has a separate 7.65% they are paying for FICA taxes on your pay.