Tax Differences: Employee vs Self-Employed (on Sch C)

Have you recently transitioned from being an employee of

company to being self-employed (or vice versa)? Or are you considering such a transition? In this post, we will explore

the main tax differences of being an employee versus being self-employed (with earnings reported on Schedule C) that you NEED to know.

Or check out our video on the same topic here.

EMPLOYEE & TAXES

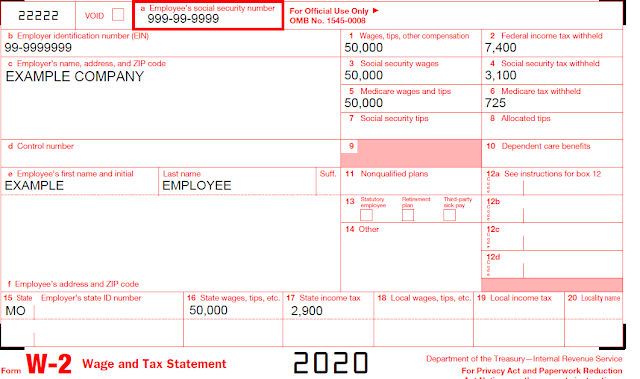

As an employee of a company, you should receive a Form W-2.

You may or may not realize exactly what this form, or your paychecks each pay

period, say about taxes. So let’s dive into that. 😊

First, we need to discuss that there are two main types of

taxes reported on Form W-2/paystubs.

- FICA (Social Security & Medicare) taxes – 7.65% deducted from each paycheck (usually you will NOT get this back at all)

- Note: The Social Security 6.2% is only accessed on the first $137,700 (for 2020) of wages

- Did you know… Your employer also has a separate 7.65% they are paying for FICA taxes on your pay. So in total, 15.3% (7.65% + 7.65%) is being paid in for FICA each paycheck.

- Income taxes – deduction for federal income taxes and state incomes taxes depend on the information you put on your Form W-4s you originally supplied to your employer

- Go towards that year’s tax payments, essentially meaning when you file your tax return, you get credit for having already paid some/all/more than enough of the tax owed for the year

EXAMPLE

FOR EMPLOYEE

Let’s

look at a very basic example of a Form W-2 to help put this in perspective.

On

this W-2, our example employee (EE) earned $50,000 in wages during the year. On

that $50,000, 7.65% of FICA taxes totaling $3,825 (box 4 + box 6) were withheld

and paid to the IRS, never to be seen again 😉. Also on that $50,000, our EE had $7,400

withheld for federal income taxes and $2,900 withheld for state income taxes to

Missouri.

When

EE goes to file the 2020 federal income tax return, EE can show $7,400 has

already been paid to the IRS for federal income taxes. If the tax liability on

the 2020 return shows $6,000, then EE overpaid by $1,400 (thus, will get a refund in that amount). The

same would be looked at for the 2020 state income tax return. If there was a

tax liability of $3,500 on the state income tax return, EE underpaid by $600

($2,900 withheld but $3,500 of tax liability). This remaining amount of $600 would

have to be paid (balance due).

Did

this employee actually receive $50,000 from their employer in the year? No,

because the employer withholds and remits these taxes to the IRS and state.

They actually received $35,875.

SELF-EMPLOYMENT (SCH C) & TAXES

As a self-employed individual, your tax situation will look

different than the above as a W-2 employee. Why is that? Because you no longer

have an employer withholding and remitting your taxes from each paycheck.

- Self-employment taxes – the equivalent of FICA tax for the W-2 employee except you know are the employee AND the employer…thus you owe the full 15.3% (7.65% + 7.65%)

- Income taxes – same as when you were an employee (all things remaining equal)

On

the two types of taxes above, since you don’t have an employer withholding some

from each paycheck to send in on your behalf to the government towards taxes, you

now may be required to send in quarterly estimated tax payments to the IRS and state

yourself. Why? Because our tax system is a “pay-as-you-go” system. If you don’t

pay these, you may be subject to underpayment penalties and/or you will owe it all

when you go to file your tax return.

EXAMPLE FOR SELF-EMPLOYED INDIVIDUAL

Let’s say that you have a net income (revenue minus

expenses) of $50,000. On that $50,000, if you didn’t send in estimated tax

payments, then $0 was paid in for FICA or federal and state income taxes.

Therefore, all of the tax will be due when you go to file your tax return.

You

can see that there is 15.3% on the $50,000 of net income as the self-employment

taxes. Then we assumed that the federal income tax liability and state income

tax liability remained the same as with our earlier example of the W-2 example

employee. The only difference is that now $0 has been paid in to the IRS or

state.

Next,

let’s look at how much this self-employed individual would “take home” after

taxes have been paid.

While

the total pay the self-employed individual received during the year was

$50,000, he/she will have to pay $17,150 in taxes thus reducing the net pay

they get to $32,850. If this tax isn’t budgeted for, this could be a surprise

tax bill.

MAIN DIFFERENCES SUMMARY

In our examples above, though both the employee and

self-employed individual earned $50,000, the employee essentially ended up

paying $13,325 in FICA taxes + federal and state income taxes, whereas the

self-employed individual essentially ended up paying $17,150 in self-employment

taxes + federal and state income taxes. However, the employee received a refund

of $1,400 from the IRS and owed the state $600 due to tax withholdings by

his/her employer on each paycheck. The self-employed individual owed the entire

$17,150 (if he/she made $0 in estimated tax payments). See below for an

easier-on-the-eyes comparison. 😊

Side note: If your business is set up as a LLC, you can elect to be taxed as an S Corporation. With this, you have a separate tax return, a requirement for payroll, and more robust accounting requirements, but you can save on self-employment taxes. How? Well, you only will pay those self-employment/FICA taxes on your reasonable wage (as an S Corp, you are now the employer that issues you, the employee, a W-2). Anything you take out of the company beyond the reasonable wage isn't subject to payroll tax! (A separate post and video will dive deeper into this consideration.)

As always, feel free to reach out to us at Arndt &

Company with any questions!

Thank you!

Kayla Weaver, CPA