Employee Retention Credit - Update and What to Know for Your Business

Back in 2020, Congress passed the Cares Act in order to provide relief for those businesses and individuals suffering from the negative effects that COVID was having on the economy. Within the Cares Act there was a credit called the Employee Retention Credit (ERC). Many taxpayers ignored this credit because they were prohibited from claiming the ERC if they applied for and received a Payroll Protection Program (PPP) loan.

Packed inside the thousands of pages of the Consolidated Appropriations Act, 2021 (CAA) passed December 20, 2020 were some favorable updates to the ERC. Two of the most notable changes are...

- The ERC is extended through June 20, 2021.

- The ERC is now available retroactively in 2020 to businesses that took a PPP whereas previously it wasn't.

This means that if you did not consider the ERC in 2020 (or were not eligible to consider the ERC because you took a PPP loan), you now have an opportunity to go back and claim the ERC on 2020 wages and receive a refundable tax credit for previous quarters in 2020.

What is the amount of the ERC?

- $5,000 per employee for 2020

- $14,000 per employee for 2021

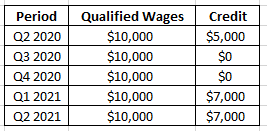

Example:

- Employer pays $10,000 in qualified wages to employee in each of Q2 2020, Q3 2020, Q4 2020, Q1 2021 and Q2 2021.

So, potentially you could receive up to $19,000 per employee. This is a refundable payroll tax credit, which means the money is refunded to you even if your tax liability is zero. The one caveat is that the ERC and PPP loan forgiveness can not be claimed on the same wages.

The first step in determining if you qualify is to see if you are an eligible employer, with qualified wages paid in a qualifying quarter. Let's start with the 2020 rules established under the CARES Act then we will review what changed for 2021.

The ERC for 2020

Who is an Eligible Employer?

You are an eligible employer if you meet either one of the following two tests:

- Your business must have had operations that were fully or partially suspended by a COVID-19 governmental order or during the period of the order's enforcement

- Here is a link to an IRS FAQ providing examples of what qualifies as fully or partially suspended business

- Business such as restaurants, retail and other stores that had to adjust their operations (i.e., provide outdoor dining, provide for curbside services) would normally qualify as fully or partially suspended.

- OR, your business had a decrease in gross receipts of 50% or more for the 2020 credit (20% or more for the 2021 credit) compared to the same quarter in 2019.

- You will continue to qualify until gross receipts reach 80% or more of the corresponding prior year period.

What are Qualified Wages?

- Qualified wages depends on the size of the employer.

- Small employers (< 100 employees during 2019) - all wages qualify for the credit.

- Large employers (> 100 employees during 2019) - only wages paid to employees who were not performing services

- Wages must have been paid between March 12, 2020, and Dec. 31, 2020.

- Health benefits paid for employees also qualify.

- The maximum credit is 50% of the first $10,000 paid to each employee, or $5,000 per employee.

- Wages must be paid in a qualifying quarter.

- A

quarter in which business operations are fully or partially suspended by

government order.

- The wages must be paid during the period of shutdown.

- Ex: If a shutdown is in

effect from May 1 through May 31, only wages paid during those dates will

qualify.

- A

quarter in which the business experiences a significant decline in gross

receipts.

- A

decline in gross receipts is defined as a quarter in which gross receipts declined 50% or more for the same quarter in 2019.

- A

business will continue to qualify until the completion of a quarter in

which gross receipts reach 80% of the 2019 amount.

Changes to the ERC for 2021

The CAA extends the ERC through June 30, 2021.

Also, the ERC eligibility and limits were changed as follows:

- Reduced the quarter over quarter gross receipts decline from 50% to 20%, comparing the 2021 calendar quarter to the corresponding quarter in 2019 (rather than 2020)

- Increased the ERC wage limit to $10,000 per employee per quarter rather than $10,000 per year

- Increased the ERC percentage from 50% to 70% of gross wages

- The limit of wages creditable per employee goes from $10,000 in a year to $10,000 in a quarter.

- Increased the "large employer" full time employee limit from 100 to 500

- Clarified that ERC wages cannot be used for several other tax credits - most notably Work Opportunity Tax Credit (WOTC) and R&D

- New employers who were not in existence for all or part of 2019 can use the comparable 2020 calendar quarter to determine the extent of the decline in gross receipts.

The IRS issued a new version of Form 941 Employer’s Quarterly Federal Tax Return in July of 2020. The qualified wages for the ERC as well the credit applied will be reported.

Employers can also file Form 7200 for

advance credits anticipated for a quarter at any time before the end of the

month following the quarter in which the employer paid the qualified wages.

If you have any questions about the information discussed here just drop us a line.

For the latest tax updates be sure to follow us on Twitter, Facebook and LinkedIn. You can also visit our website at https://arndtcpas.com or give us a call at (417) 882-9000.