2021 Tax Law Changes – Individuals

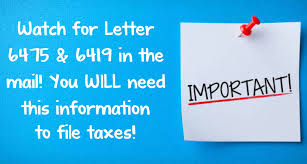

Each calendar year provides unique challenges and updates to tax law impacting businesses and individuals. This post will highlight some of the major changes for individuals. If you wish to see tax law changes affecting businesses, you can go here. Article Highlights Economic Impact Payments – Third Round Educator Expenses Charitable Contributions for Non-Itemizers Charitable Contributions for Itemizers Child Tax Credit Child & Dependent Care Credit Earned Income Tax Credit Premium Tax Credit Education Credits Dependent Care Assistance Plans Cryptocurrency Reporting Student Loan Discharge Student Loan Relief New Above-the-Line Deductions Pell Grants Unemployment Benefits Net Investment Income Tax Surcharge on High-Income Taxpayers Required Minimum Distributions (RMDs) and COVID Distributions The Home Office Deduction IRS Processing Challenges On December 27, 2...