Self-Employed & Taxes: Schedule C vs S Corporation

Are you self-employed and want to save on self-employment taxes?

Then becoming an S Corporation might be a great option for you! Below we will

go over the basic taxation you will see as a Schedule C versus an S

Corporation, outline when it makes sense to become an S Corporation, and discuss

how to become an S Corporation.

Note: Income taxes are the same under either scenario, so

we will only be comparing PAYROLL taxes.

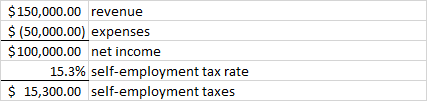

PAYROLL TAXES USING SCHEDULE C

EXAMPLE FOR SCHEDULE C

PAYROLL TAXES AS AN S CORP

As an S Corporation, you are now an employee of your

business. Your business will issue you a Form W-2 at year-end for the wages

paid to you during the year. Anything not paid out as wages you can take out as

a shareholder distribution with no negative tax impact (assuming you have

adequate basis…we won’t get into those details here).

In addition, the factors the IRS mentions as part of determining reasonable compensation include:

- training and experience

- duties and responsibilities

- time and efforts devoted to the business

- dividend history

- payments to non-shareholder employees

- timing and manner of paying bonuses to key people

- what comparable businesses pay for similar services

- compensation agreements

- the use of a formula to determine compensation

Obviously there is some incentive to keep wages lower to pay

less in payroll taxes. Therefore, we encourage you to keep documentation of the

methodology you used to support your reasonable wage amount, should the IRS

ever request it in an audit.

EXAMPLE FOR S CORP

The same as our Schedule C example, let’s say

you have net income of $100,000. You determine that a reasonable wage would be

$35,000. Instead of paying 15.3% on the $100,000 of net income, you are now

only paying that 15.3% (plus a tiny bit more for state unemployment taxes and

federal unemployment taxes) on the $35,000 of wages. That means $5,355 of FICA

taxes (the W-2 equivalent of self-employment taxes). The remaining ~$65,000 of

profit could be distributed payroll tax free!

SIDE-BY-SIDE COMPARISON

WHEN DOES IT MAKE SENSE TO BECOME AN S CORPORATION?

- an additional tax return – an S Corp files Form 1120S with a due date of March 15 (can be extended 6 months to September 15)

- payroll processing fees – there will be monthly/quarterly/annual payroll form requirements so we recommend hiring a payroll processor to file these and remit the payroll taxes

- accounting fees – an S Corp return is more sophisticated [than a Schedule C], as it has Balance Sheet accounting; thus, we highly recommend (and require for our clients) hiring an accounting professional to either completely maintain your financials or at a minimum, do an annual tie out/review of the financials (note: we use QuickBooks for all of our clients)

- state fees – some states, such as California, charge a minimum amount for an S Corp in their state ($800 minimum for California); you will need to look at your specific state to see its rules and regulations

Therefore, it would be advantageous to estimate your payroll

tax savings vs your additional costs.

Another

potential motivation in becoming an S Corporation beyond just the net savings:

a Form 1120S is approximately 5 times LESS LIKELY to be audited

as compared with Schedule C on your Form 1040.

HOW TO BECOME AN S CORPORATION

There are two ways to become an S Corporation. The first,

and most common way we deal with, is to elect to have your LLC (Limited

Liability Company) taxed as an S Corporation. The second, less common way is to

set up a true-blue Corporation. In either case, you will file Form 2553 with

the IRS which tells them you are choosing to be taxed as an S Corporation.

IMPORTANT NOTE: The earliest

date you can elect to be treated as an S Corp is the date your LLC was formed.

If you were operating as a sole proprietorship (without an LLC) before, then

you first need to create an LLC as the potential start-date of your S

Corporation election. Technically you have 3 months from the date the LLC was

formed or the first day of the tax year (if not your 1st year of

operation) to elect S Corp status with the IRS, though we have been very successfully

in filing late elections.

As always, feel free to reach out to us at Arndt &

Company with any questions!

Thank you!

Kayla Weaver, CPA