Self-Employed & Taxes: Schedule C vs S Corporation

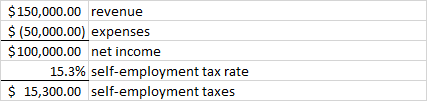

Are you self-employed and want to save on self-employment taxes ? Then becoming an S Corporation might be a great option for you! Below we will go over the basic taxation you will see as a Schedule C versus an S Corporation, outline when it makes sense to become an S Corporation, and discuss how to become an S Corporation. Note: Income taxes are the same under either scenario, so we will only be comparing PAYROLL taxes. To see the blog on comparing taxation as a W-2 employee and self-employed on Sch C, click here . PAYROLL TAXES USING SCHEDULE C Whenever you are self-employed reporting your earnings on Schedule C, you pay 15.3% of self-employment (SE) taxes on your net income. Why? Because you aren’t on payroll (like a traditional W-2 employee) but are still required contribute towards the Social Security and Medicare systems. (Note that the Social Security part of the SE tax is 12.4% maxed at $137,700 [for 2020].) EXAMPLE FOR SCHEDULE C Let’s say that you have ...