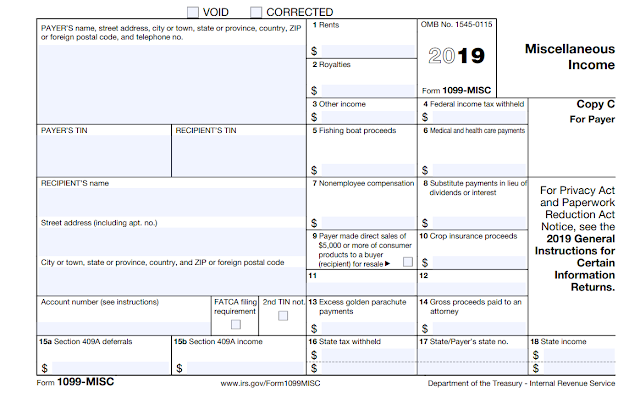

Another January, Another 1099-MISC Deadline

Another year has flown by and is almost in the books. With that means the Form 1099-NEC and 1099-MISC filing deadline is just around the corner ( January 31 for most). Here are some key facts to remember about 1099's as we approach the new year. 1) Bank account activity needs to be entered and reconciled through December 31. So if you’re not caught up through November (or September if a quarterly A&Co client), you’ll want to get on that ASAP so that there’s only one month/quarter to do in January. NOTE: Checks dated in 2023 that don’t clear until 2024 still must be counted towards 2023! They’ll simply appear as an outstanding item on the bank reconciliation. 2) Anyone paid $600 or more for services OR rents OR potentially a combination of services and materials by cash, check, or bank wire/ACH/transfer ( cumulative in the calendar year) require a 1099-MISC to be filed, unless the Form W-9 indicates otherwise…a little more on that later. Payme...