Form W-9: Do I REALLY Need It?

Chances are as a small business owner you’ve heard of Form

W-9...and if not, there’s good news – I’m about to tell you all about it 😉.

Maybe you’ve been requested to provide it to a customer, or maybe I’ve asked

you to get one for a contractor you’ve paid. But do you understand why you’re requesting

this form (or why it’s being requested of you), and what its purpose is?

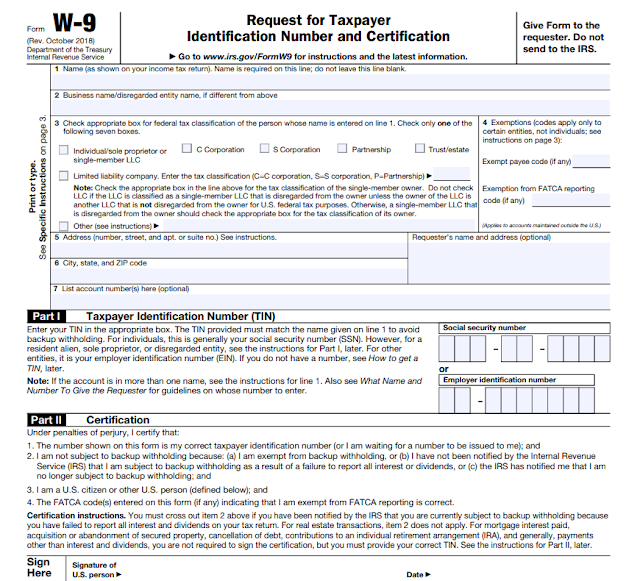

The Form W-9 essentially is an informational form

that helps with Form 1099-MISC processing (that’s our primary focus here

at least). The W-9 lists the person’s/company’s name, entity type, address,

taxpayer identification number (either SSN or EIN), and signature

certification. This gives all of the necessary information needed to file a

Form 1099-MISC, other than the actual dollar amount

paid to the person/company during the year (which should be available in

your accounting records). It also certifies that the person/business is not

subject to backup withholding, which essentially means that you as the

payer would not be required to withhold 24% of their payments and send to the IRS for this

backup withholding.

Don’t have a blank Form W-9 handy, or does your contractor

give you something else in lieu of it? Technically the IRS says you can use a

substitute Form W-9 as long as its content is substantially similar to the

IRS’s official form, and it satisfies certain certification requirements (which

I won’t get into) – however, we highly recommend you just use the IRS

Form W-9 to be safe.

If you have some people/companies that you are still needing to get a W-9 from, I encourage you to request them ASAP to make January 1099 processing smoother and less stressful. 😊 And if we file your company’s 1099-MISCs, go ahead and get us a copy of those completed Form W-9s as well – we keep them in our secure FileCabinet server in perpetuity.

You can download a blank copy of Form W-9 directly from the

IRS website at https://www.irs.gov/pub/irs-pdf/fw9.pdf

and it also includes general instructions on filling out the form.

As always, feel free to reach out to us at Arndt &

Company with any questions!

Thank you!

Kayla Weaver, CPA

Disclaimer: This article is not intended to be tax

advice, and it does not cover all possible scenarios and/or rules within the

tax code. Please contact your CPA for further information or clarification.