Another January, Another 1099-MISC Deadline

Another year has flown by and is almost in the books. With

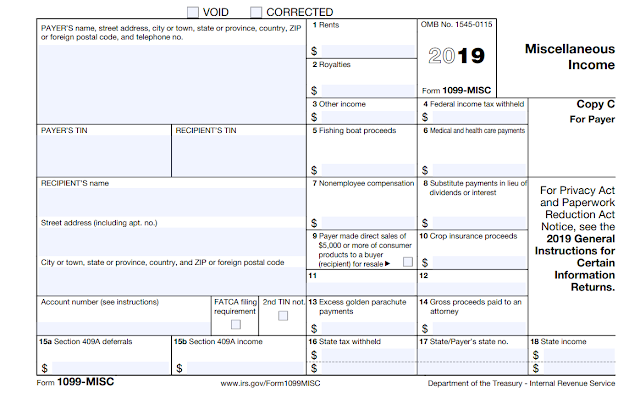

that means the Form 1099-NEC and 1099-MISC filing deadline is just around the corner (January 31 for most).

Here are some key facts to remember about 1099's as we approach the new year.

1) Bank account activity needs to be entered and

reconciled through December 31. So if you’re not caught up through November (or

September if a quarterly A&Co client), you’ll want to get on that ASAP so

that there’s only one month/quarter to do in January.

- NOTE: Checks dated in 2023 that don’t clear until 2024 still must be counted towards 2023! They’ll simply appear as an outstanding item on the bank reconciliation.

- Payments you made using your debit card, credit card, PayPal, and other payment processors do not require you to file Form 1099-MISC. Why? Because those payment processors file Form 1099-K (dependent on certain other thresholds), so it would potentially duplicate the same income.

- Cumulative vendor payments less than $600 do not require you to file Form 1099-MISC.

- Payments made for supplies, utilities, inventory, equipment, etc. are not subject to Form 1099-MISC reporting. Only payments for services (even if it’s a combination of services and materials) such as contract labor, commissions paid, rents, repairs, advertising, etc. are potentially applicable.

3) You

must have a completed and signed Form W-9 from the

vendor/contractor in order to prepare the Form 1099-MISC correctly and serve as

back-up documentation in the event that the IRS sends a letter. Start requesting

these ASAP if you know of any you’re missing! If you have supplied them to us

in the past, we will have them on file, so no need to get a new one unless

you are aware of a change in that business that might require updating.

- NOTE: The Form W-9 might indicate that a 1099-MISC need not be filed for that person/company. This is true for most, but not all, Corporations.

4) There

are potential IRS-imposed penalties for late filings. What are the penalties? Read this post to find out. You’ll definitely want to make this a

priority! It’s our top priority in January to file all 1099-MISCs for our

clients that employ us to do so.

Why does the IRS require businesses to issue 1099 forms?

Have you ever wondered why the IRS requires businesses to file these 1099-MISCs? Well essentially it is to help them track independent contractors’ income! Whereas an individual employed by a company will receive a Form W-2 which shows taxable income to the IRS, an independent contractor won’t get a Form W-2. So without Form 1099-MISC, the IRS would have almost no idea how much independent contractors earned during the year. Of course, this isn’t exact (as we learned not all payments require 1099-MISC and such), but it at least can serve as a baseline that helps the IRS pinpoint self-employed income should be reported for certain people/businesses.And why do they make you, as a small business owner, help with this?

Because you’re getting a deduction for it! And if you get a taxable deduction, they want to make sure they pick up the other side of the transaction (taxable income).

As always, feel free to reach out to us at Arndt &

Company with any questions!

Thank you!

Theresa Arndt, CPA

Theresa Arndt, CPA

Disclaimer: This article is not intended to be tax

advice, and it does not cover all possible scenarios and/or rules within the

tax code. Please contact Arndt & Company or your CPA for further information

or clarification.